Copy URL to Clipboard

Copy URL to Clipboard

To calculate Inventory Days on Hand (DOH), use the formula: DOH = (Average Inventory ÷ Cost of Goods Sold) × Number of Days in Period. By using this formula, you should be able to determine how many days your current inventory will last, helping you manage your stock levels effectively.

Adaptable, efficient businesses have a few things in common with one another. A solid knowledge of business metrics is one of those similarities, and inventory days on hand (DOH) is one of the most important metrics you can use to develop an effective, data-driven inventory strategy.

Key Takeaways

The following walkthrough will equip you with a better understanding of inventory DOH.

This figure represents the amount of time it takes for a company to sell its average balance of active inventory. It serves as an estimated length of time during which on-hand stock remains available.

Ultimately, this metric tells you the number of days your product is in stock before being sold (similar to turnover rates, but I’ll get more into that later). It lends insight to how long your capital remains tied up in inventory.

Calculating inventory days on hand and knowing how to apply the metric requires us to first examine some key terms with which it is associated.

Some terms and definitions to understand before calculating your business’s DOH include:

With these definitions in mind, we can move on to calculating inventory DOH.

To demonstrate this calculation, I’ll use a hypothetical scenario with some assumed figures.

The first step is to calculate average inventory. Let’s say you run a small business selling olive oil. You have a starting inventory of 1,000 bottles and an ending inventory of 500 over a two-month period. Your cost for each bottle is $10.00, and you sell them for $20.00 per unit.

Using the formula (starting inventory + ending inventory) / two months = average inventory, you’ll get the following result.

Since the cost of each SKU is $10.00, you can also determine the average inventory value by multiplying 750 x 10, which comes up to $7,500.

Secondly, we need to determine our COGS for the specified period of time. In addition to the figures we just used, let us also assume the business purchased another 100 SKUs worth of inventory during the specified two-month time frame.

To calculate COGS, you’ll need to add that $1,000 spend to the cost of your starting inventory, then subtract the cost of your ending inventory.

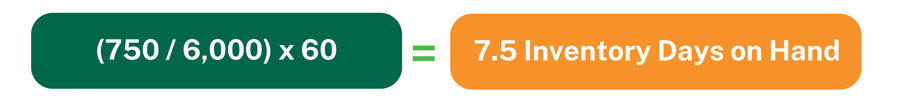

Now that we have these values, we can plug them into the formula for calculating inventory days on hand, which is (average inventory / COGS) x length of time = inventory DOH. To keep things simple, we’ll assume each of the two months in question was 30 days long, for a total of 60 days.

You might wonder why we’re doing all this math in the first place. To answer that question, let’s examine some ways we can apply this metric to create an inventory strategy that meets demand without reducing profits excessively.

In a word: efficiency. Growing businesses face the challenge of having enough inventory to meet consumer demand while keeping enough cash on hand to pay the bills. This can be difficult since demand is rarely a flat line, but more of a fluctuating curve influenced by factors such as holidays and availability of raw materials.

For example, during the Holiday season, retailers tend to see spikes in demand as people shop for gifts. To prepare for this, you use year-over-year sales data to forecast the demand increase you can expect to see. You conclude that you’ll see an average sales increase of 50% through November and December.

Using your current DOH calculation of 7.5, you realize that you’ll need to increase your days on hand inventory by a corresponding 50% to avoid going out of stock the last two months of the year. Fifty percent of 7.5 is 3.75. Adding the two figures together gives us a projected requirement of 11.25 days on hand.

By applying this metric, you’re able to order enough inventory to address increased demand without overspending.

It’s not uncommon for business owners to overlook the relationship between inventory days on hand and inventory turnover. Let’s take a moment to explore how these metrics correspond to one another.

Think of inventory turnover and days on hand as two sides of the same coin. Generally speaking, the higher your turnover ratio, the lower your inventory DOH.

The most accurate formula you can use to determine your turnover ratio is COGS / average inventory. In the example I’ve been using, the calculation would be:

Within the original two-month time period, inventory was sold through eight times. This is considered a fairly high turnover rate, which is a good thing for most businesses.

Let’s compare high and low ratio turnover rates to see what they might indicate about the efficiency of your inventory strategy.

If goods go unsold for an extended time, all they’re doing is eating into your bottom line. Knowledge of inventory days on hand and turnaround ratio is critical to the success of any business venture.

If you’re experiencing low turnover and high DOH, your first step toward optimization will probably be selling through slow-moving inventory. Doing so will free up storage space for new goods that (hopefully) will sell more quickly and consistently than your low-ratio stock.

Some tried and true strategies for selling through excess inventory include:

While a high turnover ratio is usually favorable, it may indicate insufficient stock on hand to meet even minor, unexpected surges in demand. In order to avoid a stockout situation, you might consider purchasing safety stock. This is a form of calculated overstocking that ensures sufficient on-hand inventory without overspending.

Whether you’re adjusting inventory levels up or down, doing so with data from advanced inventory management software will simplify the process and provide more accurate insights than manual calculations.

Related: Types of Warehouse Management Systems

We’ve touched on the fact that calculating and optimizing your inventory DOH drives efficiency for your business, but there are more specific benefits to discuss. These include:

Not every business owner has the time and bandwidth to use this calculation to their full advantage. This is why they’ll often outsource inventory management to an experienced third-party logistics provider.

Related: 10 Reasons You Need to Outsource Inventory Management to a 3PL

When you can effectively balance available inventory with all the other costs of doing business, you set yourself up to succeed in the competitive world of retail. However, whether you run a traditional brick-and-mortal location or an ecommerce platform, achieving that balance is no easy task.

Partnering with experts in warehousing and order fulfillment can make this a far easier process. That’s where we come in.

Fulfillment and Distribution provides a wide range of services for businesses looking to outsource some or all of their storage and shipping needs to a 3PL. We employ cutting edge warehouse management systems that provide clear insights into metrics like inventory days on hand. With this data, you can easily make informed decisions about how much on-hand inventory you need to maintain in a given period of time.

Trust us with:

Call us today at (866) 989-3082 or request a quote online. We’re ready to help you optimize your inventory and maximize your profits.