Copy URL to Clipboard

Copy URL to Clipboard

Going into the import and export business involves coordinating multiple moving parts. Arranging shipping and warehousing while keeping up with documentation to pay duties can slow you down. The advantages of a bonded warehouse can help you solve some of those challenges.

Key Takeaways

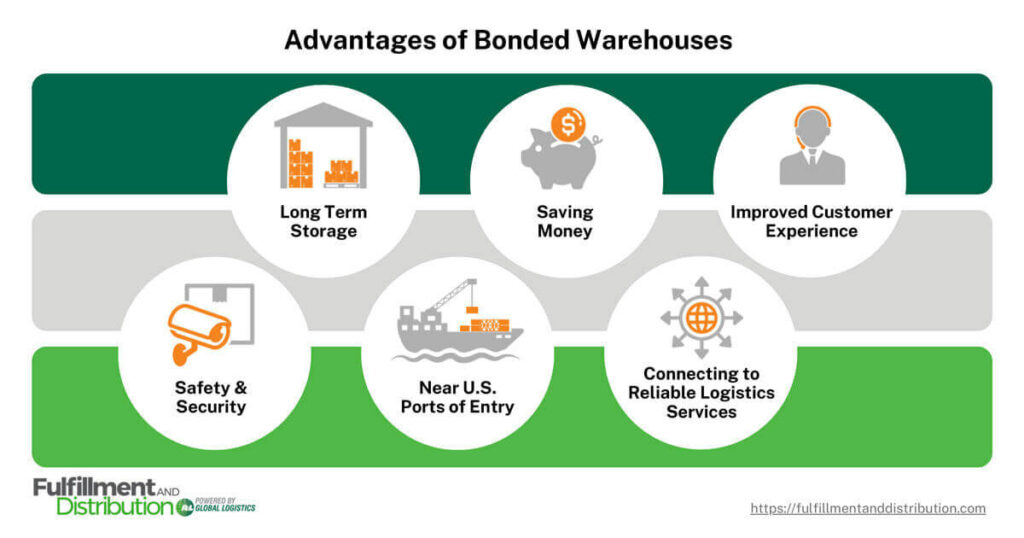

Learn about six ways that bonded warehousing can give your import/export business an advantage among your competitors.

Table of Contents

A customs bonded warehouse, or simply a bonded warehouse, is one where importers can store shipments for up to five years without paying duties or tariffs. Bonded warehouses are regulated by the CBP. Importers can store merchandise in a these facilities

This and other benefits may provide importers with financial and logistical advantages. CBP authorizes 11 different classes of customs warehouses to cover multiple types of merchandise. Warehouses can be public or private, and some can even be used for manufacturing purposes.

Consider these six specific ways that advantages offered by these facilities can help you and your business.

A common problem in international trade is determining the best storage solution for any given shipment of goods. Imported merchandise needs to be stored for domestic market distribution or for manufacturing to export back out of the country.

Dutiable imported goods can be stored in a bonded warehouse for up to five years without having to pay import tax. Being in bond also locks in the amount of duty tax.

Store merchandise safely in a customs warehouse until the market for them picks up again. A business may still make a profit from their imports this way.

These long-term solutions are available for a variety of goods. There are facilities with refrigeration, dry storage, and even live animals.

Related: How to Manage Warehouse Inventory

The cost of international shipping is notoriously volatile. Data compiled by Statista shows rates for 40-foot containers going from $1,342 in October 2023 to $5,900 in July 2024. At the same time, the cost of getting freight from ports to distribution centers and retailers is also rising. Businesses need to find a way to maximize their profits while keeping products affordable enough to be sold.

Bonded warehousing can help shippers meet that goal in two different ways:

Each of these can help your business differently.

When goods enter a bonded warehouse, the owner of the facility assumes a liability, or bond, for that merchandise. Customs duties will not need to be paid until the merchandise is withdrawn for domestic consumption in the United States.

Keeping goods that aren’t selling can drag your profits down. Paying duties up front when sales aren’t strong can only make this issue worse.

Storing imported inventory in a bonded warehouse can save your company enough money in the short term to survive long-term.

Wait for supply chains and demand to return to their normal behaviors. Your business may then be able to sell your inventory at a profitable price.

A business that imports components and raw materials to export after manufacture or alteration can also benefit greatly cost-wise. A shipment destined for a standard, non-bonded warehouse must have its duties paid once it reaches its point of entry. Payment of import duties is not required for merchandise being sold for export.

Certain bonded warehouse classes let you alter and manufacture imported items without paying the import tax. So long as the items don’t enter the domestic market, the payment is deferred. Double tax is then avoided when possible, providing some companies with over 25% in tax savings overall.

Some product demands are more predictable than others, such as seasonal items. Merchandise connected to major holidays or national events also has a reliable pattern of customer demand.

Because long-term storage is possible at a customs bonded warehouse, merchandise can be ordered and stored ahead of demand. Having in-demand merchandise ready to ship is an easy way to meet customer expectations and set your business ahead of the pack.

Trying to get ahead of next fall’s pumpkin spice craze? Want to have popular jerseys on hand for the FIFA World Cup? Using bonded warehousing services allows you to stock up ahead of time. When the demand goes up, items can be sold and shipped in a timely manner, earning your business happy and loyal customers.

Related: What is Demand Planning?

Getting your merchandise into the U.S. is only one step of the import industry. Once your shipment arrives, you need to be sure it will remain at a secure location while awaiting distribution. Any decent warehouse can offer security, but bonded warehouse facilities take security to a higher level.

Merchandise stored in a bonded warehouse is under the joint custody and supervision of CBP and the warehouse owner. Because of government oversight on the facilities, extra precautions are in place to ensure security of goods and related documentation. CBP conducts regular audits to ensure that these measures remain in place.

Customs warehouses must meet the following safety and security requirements:

Depending on the class of warehouse, other customs supervision may be required of the warehouse owner. The oversight means bonded warehouses are extremely secure, providing you with peace of mind when importing and storing high-value items.

Bonded warehouses are also a unique solution for storing restricted imports. Direct CBP oversight of bonded facilities allows storage of restricted goods for longer periods of time than standard warehouses.

Restricted goods come with require a litany of documents and paperwork. Haste makes waste. Errors on the documents are likely to get your goods destroyed upon entry and land you with the cost for it. With the option for long-term storage and CBP oversight, you have more time to verify the accuracy of your documents.

Bonded warehouses are usually established near ports of entry, since they’re specifically intended for imported goods. CBP has over 300 ports of entry between the continental U.S., Puerto Rico, and the U.S. Virgin Islands.

When shipping to any of these ports, CBP will likely have a bonded warehouse nearby that can meet your needs. Many of the main import venues in the U.S., such as the Port of Los Angeles, are overwhelmed with shipments. The same can be said of nearby warehouses.

Since bonded warehouses are located even at less popular ports, you may find them more easily than a short-term, non-bonded facility. A warehouse in proximity to a port of entry may also save you money on freight forwarding and transloading services.

Many bonded warehouses contract with various carriers and freight forwarders to offer diverse shipping options to their clients. The strict regulations under which these warehouses operate means their partners are guaranteed to be thoroughly vetted prior to arranging services.

Owners of bonded warehouses wouldn’t want to do business with questionable carriers. CBP may be quick to revoke the warehouse owner’s operating permission in case of a violation.

Bonded warehouses are used frequently with in-bond transactions. These transactions allow cargo to be moved from port and through the U.S. without paying customs duties. Bonded carriers would be used in these transactions, and are regulated in much the same way warehouses are.

Bonded carriers are often distinguished according to mode of transportation, such as:

Safety and security continue to be priorities outside the physical location, too. Carriers, cartmen, or container stations that handle in-bond merchandise must have an Activity Code 2 (C2) Bond from CBP. The bond keeps them compliant with all the same regulations as a warehouse, creating consistency across the entire logistics process.

Moving and storing freight can be expensive. Trade disruptions from accidents, natural disasters, and terrorist attacks at sea have made those costs even higher, creating trying times for even the most experienced business owners.

The six advantages we’ve discussed may help your import business keep growing despite the challenges. However, bonded warehousing is just one option among hundreds that could boost your business’s performance. Consult with the logistics experts at Fulfillment and Distribution to help you answer any questions you have about your storage and shipment needs.

Our full list of logistics services includes

Give us a call at (866) 989-3082 or request a quote today and find out how our services can help you.

I am looking into the viability of sell New Zealand made Health Supplements into China, and wanted some honest feedback regarding the costs, timing, regulatory, transportation and tax implications of doing so.

Can someone come back to me on this, please?