Copy URL to Clipboard

Copy URL to Clipboard

A bonded warehouse might sound too good to be true. You’ve been struggling to pay duties on merchandise that isn’t selling, and now you find out there is a way to avoid that.

Key Takeaways

Learn the basics of bonded warehouses, the benefits of using them, their requirements, and more.

As mentioned, a bonded warehouse is a storage area for imported goods that duty tax must be paid on. Although the term warehouse is used, it can be any secure space, building, or otherwise. Bonded warehousing was developed to help shippers better manage their merchandise and allow them time to prepare goods for distribution.

You can keep your goods in a bonded warehouse for up to five years without paying the duty fees. During this time, you can make any necessary changes to get your imports ready for distribution. This could mean changing packaging, adding necessary labels, or even just waiting until demand has increased.

Bonded warehouses are found in countries all around the world, but they are not subject to any sort of international regulation. While the general purpose is similar, each nation will have unique regulations in place that should be investigated before you decide to use a bonded warehouse outside U.S. authority.

The main difference between these two types of facilities is the bonded warehouse’s connection to U.S. Customs. This connection is what allows importers to defer payment of duties until goods leave the warehouse.

In the case of a non-bonded facility, duties and taxes may need to be paid to CBP up front. There is also an increased chance that any errors in paperwork or unexpected delays will cause your merchandise to be seized or even destroyed. These warehouses are more likely to be used for the storage of domestically produced merchandise for these reasons.

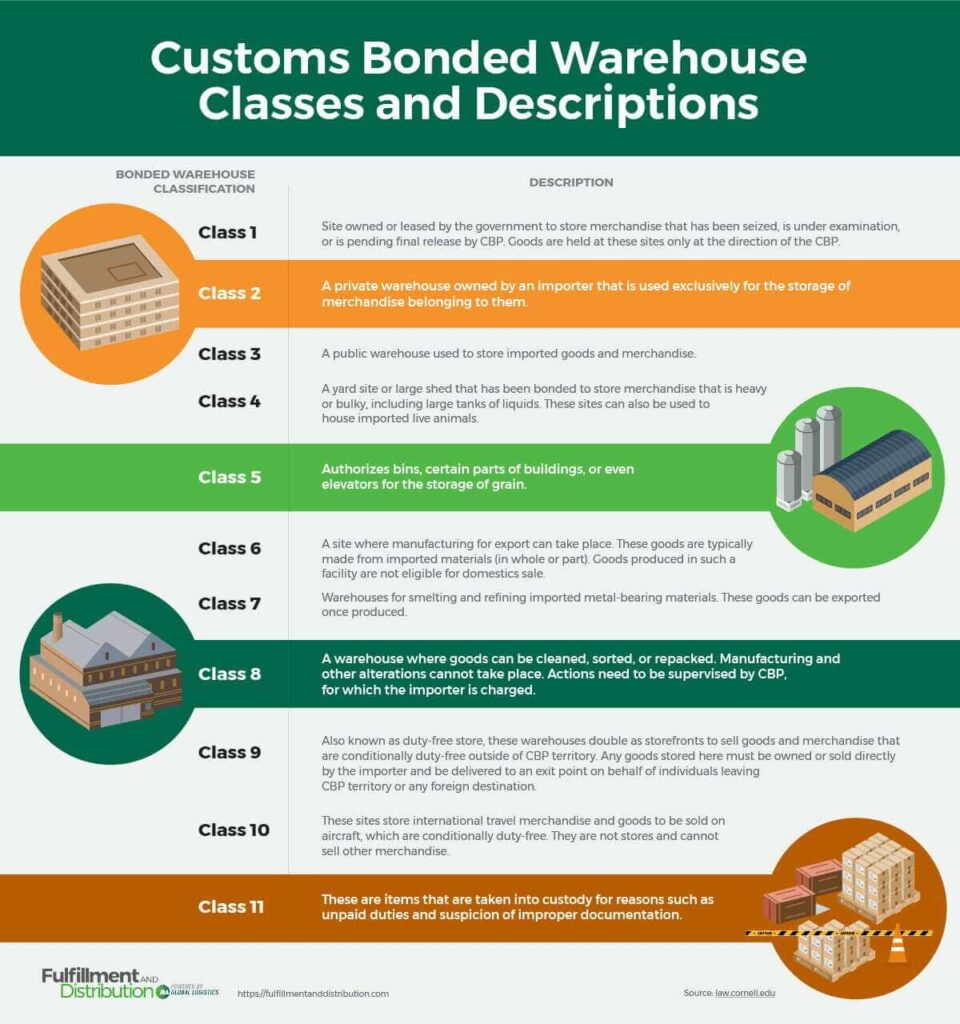

Thousands of different goods are imported into the U.S. annually, from vehicle parts to tropical fruits. Such a wide variety of products requires an equally varied selection of suitable warehouses.

Depending on your needs, there are 11 different classes of bonded warehouses in the United States as defined by CBP. I’ve listed those classes in the table below, along with the specific purpose of each class.

These classes are specific to the U.S. and may not apply to other countries. If you are considering using one of these warehouses, consult an expert with knowledge about the variety of options and differences found internationally.

Depending on the class, bonded warehouses can be used by CBP, warehouse owners, importers, and related third parties. For these parties, CBP provides a bonded warehouse manual that details the application process, types of merchandise allowed, and more.

Whether an importer chooses to use a customs warehouse or not is another matter. Small scale importers, who don’t ship in large quantities or often, may wish to bypass this additional step. If you manage distribution and fulfillment through a 3PL, be aware that not all logistics companies offer bonded warehousing services.

If your shipping practices have changed, or you find yourself in need of a bonded warehouse, it’s wise to talk with an experienced 3PL first. For example, our team of logistics experts can talk through your specific scenario to determine if a customs warehouse is a viable solution based on your unique needs.

While goods are kept within a bonded warehouse, the importer doesn’t have to pay the import taxes. In that sense, yes, bonded warehouses are duty-free.

However, except for class 9 warehouses, these sites are not set up for retail distribution. The duties owed for the imports have not been canceled, only deferred. Once the goods are taken out and made available for sale in the United States, the import tax must be paid.

There are three exemptions that allow merchandise to be released without payment of duties.

Customs warehouses are meant to help importers secure merchandise until buyers can be found or until the imported goods have been altered to make them eligible for sale. All imported products sold in the U.S. are subject to applicable duties.

These storage facilities are often found near ports of entry in the United States. The busier the port, the more likely there is to be a variety of warehouses available. Facilities approved for manufacturing products using imported materials can be found farther away.

Working with a 3PL logistics company for your warehousing needs may help you find a location that meets your needs.

During economically challenging times, a customs bonded warehouse can be an import business’ saving grace. The ability to keep goods and merchandise safe and secure while deferring customs duties has helped many businesses avoid bankruptcy.

Consider these other specific benefits:

When importers face disruptions to their supply chain or get overwhelmed by inventory that isn’t in demand, bonded warehousing can provide short and long-term solutions for storing their goods until the market improves.

There are few disadvantages to bonded warehouses for importers. However, there are certain restrictions to consider.

Despite these restrictions, bonded warehouses remain the most common and secure way importers have of protecting their shipments and their businesses.

If you want to establish one of these warehouses, applications are done through CBP. The requirements are as follows:

Some classes of warehouses have additional requirements, so be sure to check with official CBP guidelines during the application process.

Deciding if a bonded warehouse is the right solution for your import storage needs can be difficult, especially if you’re not familiar with the intricacies of U.S. customs laws. However, you don’t have to make that decision without knowledgeable assistance.

The warehousing experts at Fulfillment and Distribution can help you determine if bonded warehouses are right for your needs. We can also assist you with finding solutions for:

Give us a call at (866) 989-3082 or submit a contact form online today. Our team is standing by to help your business grow to new heights.